Content

Is a law mandating a type of tax that both employers and employees pay to help fund Social Security and Medicare. It’s important to note that the rules differ for employees who receive tips. Also, the employer does not contribute to the Medicare surtax, also known as Additional Medicare Tax, of 0.9 percent that is imposed on high-earning employees. With Social Security, the 6.2 percent tax applies to earnings up to $132,900. Employees are not required to pay the Social Security tax on any income earned above this amount. FICA tax funds Social Security Trust Funds and the Medicare Hospital Insurance Trust Fund, respectively, and pays for benefits related to those government programs.

For more information, see the Instructions for Form 8959 andQuestions and Answers for the Additional Medicare Tax. Almost everyone working as an employee will have FICA taxes deducted from their wages. Monthly tips under $20, workers’ compensation, employer contributions to retirement plans, employee insurance, and family employees under 18 are all exempt from FICA. Students involved with a work study program at their university may be exempt, if they meet certain qualifications.

How does FICA impact you?

Since 2013, the Additional Medicare Tax of 0.9 percent when the employee earns over $200,000. Serving legal professionals in law firms, General Counsel offices and corporate legal departments with data-driven decision-making tools. We streamline legal and regulatory research, analysis, and workflows to drive value to organizations, ensuring more transparent, just and safe societies. Only limited material is available in the selected language.All content is available on the global site. Buy Side from WSJ is a reviews and recommendations team, independent of The Wall Street Journal newsroom.

Some employees pay more Social Security taxes than they need to. This could happen if you switch jobs more than once and all of your earnings are taxed, https://quick-bookkeeping.net/periodic-inventory-system-definition/ even if your combined income exceeds the Social Security wage base limit. Fortunately, you may be able to get a refund when you file your taxes.

Three Important Takeaways from This Article That You Should Remember about FICA Taxes

A wage base limit applies to employees who pay Social Security taxes. This means that gross income above a certain threshold is exempt from this tax. The wage limit changes almost every year based on inflation.

- A simple tax return is one that’s filed using IRS Form 1040 only, without having to attach any forms or schedules.

- So the FICA tax that you pay is like being forced to save money for your retirement.

- UpCounsel is an interactive online service that makes it faster and easier for businesses to find and hire legal help solely based on their preferences.

- We have such confidence in our accurate and useful content that we let outside experts inspect our work.

- There is no comparable earnings maximum for Medicare; the 1.45 percent Medicare tax included in FICA is levied on all of your work income.

- Almost everyone pays FICA taxes, even resident aliens and nonresident aliens .

Part of President Franklin Roosevelt’s New Deal, the government started collecting FICA taxes in 1937, following the passage of the Federal Insurance Contributions Act of 1935. With millions of people out of work, the idea was to provide pensions for elderly workers. Short for the Federal Insurance Contributions Act, this 15.3% tax is paid half by you, and half by your employer. Started during the Great Depression, the FICA tax is used to fund key parts of the government’s social safety net, namely Social Security and Medicare.

What is FICA Tax: Everything You Need to Know

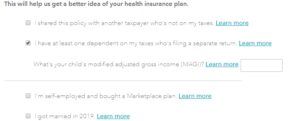

Not everyone is required to pay FICA, such as self-employed individuals. Instead, they are subject to different taxation laws, primarily SECA . 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). Yes, all employees must pay FICA taxes on their gross wages on every paycheck, including taxes for Social Security and Medicare.

This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and What Is Fica? Is It The Same As Social Security? must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital. Past performance does not guarantee future results or returns. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.