Content

As shown above, the Prepaid insurance account is debited with $10,000 to show an increase in assets, and the Bank account is credited with an equal amount to show a decrease in cash. When insurance is due and its coverage expires for each quarter, the accounts will be adjusted by the amount of the policy the company uses. Since the insurance lasts one year, we will divide the total cost of $10,000 by 12 (i.e we will adjust the accounts by $833 each month). Now, that we understand this, what journal entries will one make to record the $100 worth of insurance used and the $1,100 worth of prepaid insurance remaining? To answer this, let’s discuss the journal entry for prepaid insurance.

How do I record expired prepaid insurance?

As the prepaid amount expires, the balance in Prepaid Insurance is reduced by a credit to Prepaid Insurance and a debit to Insurance Expense. This is done with an adjusting entry at the end of each accounting period (e.g. monthly).

Accountants make the adjusting entries for deferred items for data already recorded in a company’s asset and liability accounts. They also make adjusting entries for accrued items, which we discuss in the next section, for business data not yet recorded in the accounting records. MicroTrain credits the depreciation amount to an accumulated depreciation account, which is a contra asset, rather than directly to the asset account. Companies use contra accounts when they want to show statement readers the original amount of the account to which the contra account relates. For instance, for the asset Trucks, it is useful to know both the original cost of the asset and the total accumulated depreciation amount recorded on the asset.

What Is Prepaid Insurance?

In this article, we will be discussing the prepaid insurance journal entry with some examples. The advance payment of expenses does not provide value right away. Rather, they provide value over time; generally over multiple accounting periods. The reason is that the expense expires as you use it, thus, you can’t expense the entire value of the prepaid service immediately. You can only expense a portion of the expense that has been used. So when making a journal entry for prepaid insurance, you record the prepaid expense in your business financial records and adjust entries as you use up the service.

- The journal entry for this aspect of prepaid insurance is as follows.

- Due to its nature, people may wonder whether prepaid insurance is an asset or an expense.

- Some insurers prefer that insured parties pay on a prepaid schedule such as auto or medical insurance.

- At the end of each accounting period, adjusting entries are necessary to recognize the portion of prepaid expenses that have become actual expenses through use or the passage of time.

- The adjusting entry TRANSFERS $1,000 from Prepaid Rent to Rent Expense.

Here are the ledgers that relate to the purchase of prepaid taxes when the transaction above is posted. Here is the Taxes https://www.bookstime.com/ Expense ledger where transaction above is posted. Here is the Rent Expense ledger where transaction above is posted.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

As a college student, you have likely been involved in making a prepayment for a service you will receive in the future. If you want to attend school after the semester is over, you have to prepay again for the next semester. The trial balance, drawn up on 31 December 2019, assumed that he had no other insurance and his insurance expenses account would show a balance of $4,800. Upon signing the one-year lease agreement for the warehouse, the company also purchases insurance for the warehouse. The company pays $24,000 in cash upfront for a 12-month insurance policy for the warehouse. Expired insurance refers to the sum of insurance premium against which the period of coverage has expired.

- Office supplies provide an example of a prepaid expense that does not appear on another company’s books as unearned revenue.

- It’s no longer a matter of whether or not to digitally transform.

- After one month, $1,000 of the prepaid amount has expired, and you have only 11 months of prepaid rent left.

- The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

- Here are the ledgers that relate to the purchase of supplies when the transaction above is posted.

Another example of prepaid expense relates to supplies that are purchased and stored in advance of actually needing them. At the time of purchase, such prepaid amounts represent future economic benefits that are acquired in exchange for cash payments. This means that adjustments are needed to reduce the asset account and transfer the consumption of the asset’s cost to an appropriate expense account.

Featured Businesses

The remaining $900 in the Supplies account will appear on the balance sheet. This amount is still an asset to the company since it has not been used yet. On 1 September 2019, Mr. John bought a motor car and got it insured for one year, paying $4,800 as a premium. When he paid this premium, he debited his insurance expenses account with the full amount, i.e., $4,800.

How to keep your Amex Platinum hotel credit from expiring – Business Insider

How to keep your Amex Platinum hotel credit from expiring.

Posted: Thu, 01 Dec 2022 08:00:00 GMT [source]

Learn the definition of adjusting entries in accounting, and find examples. Explore the various types of adjusting journal entries, and examine how to do them. With amortization, the amount of a common accrual, such as prepaid rent, is gradually reduced to zero, following what is known as an amortization schedule.

Prepaid Rent

A prepaid expense is carried on an insurance company’s balance sheet as a current asset until it is consumed. That’s because most prepaid assets are consumed within a few months of being recorded. Insurance is typically purchased by prepaying for an annual or semi-annual policy. Or, rent on a building may be paid ahead of its intended use (e.g., most landlords require monthly rent to be paid at the beginning of each month).

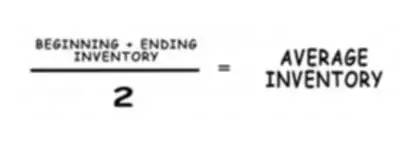

To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. This account is an asset account, and assets are increased by debits. Credit the corresponding account you used to make the payment, like a Cash or Checking account. The initial journal entry for a prepaid expense does not affect a company’s financial statements. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Note that the amount adjusted monthly is the total insurance payment divided by 12 which is the number of months in a year.

3: Adjusting Entries

The adjusting entry ensures that the amount of rent expired appears as a business expense on the income statement, not as an asset on the balance sheet. The adjusting entry ensures that the amount of insurance expired appears as a business expense on the income statement, not as an asset on the balance sheet. Deferrals prepaid insurance journal entry are adjusting entries for items purchased in advance and used up in the future (deferred expenses) or when cash is received in advance and earned in the future (deferred revenue). Keep in mind that the trial balance introduced in the previous chapter was prepared before considering adjusting entries.

- Prepaid insurance refers to the payment made for insurance in advance.

- This means that for one month, say between December 1, 2022, and December 31, 2022, $100 worth of insurance is used up.

- The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status.

- The next chapter provides a detailed look at the adjusted trial balance.

- Together with expanding roles, new expectations from stakeholders, and evolving regulatory requirements, these demands can place unsustainable strain on finance and accounting functions.

- In each successive month for the next twelve months, there should be a journal entry that debits the insurance expense account and credits the prepaid expenses (asset) account.

Such payments received in advance are initially recorded as a debit to Cash and a credit to Unearned Revenue. Unearned revenue is reported as a liability, reflecting the company’s obligation to deliver product in the future. Remember, revenue cannot be recognized in the income statement until the earnings process is complete. The remaining $6,000 amount would be transferred to expense over the next two years by preparing similar adjusting entries at the end of 20X2 and 20X3.

The same applies to many medical insurance companies—they prefer being paid upfront before they begin coverage. Receiving assets before they are earned creates a liability called unearned revenue. The firm debits such receipts to the asset account Cash and credits a liability account. The liability account credited may be Unearned Fees, Revenue Received in Advance, Advances by Customers, or some similar title. The seller must either provide the services or return the customer’s money.

This means that for one month, say between December 1, 2022, and December 31, 2022, $100 worth of insurance is used up. This means that at the end of one month, on December 31, 2022, the reporting amount of prepaid insurance on the balance sheet will be $1100 (i.e $1,200 – $100). While the insurance used for December ($100) will be reported on December’s income statement as an Insurance Expense. The adjusting entry ensures that the amount of supplies used appears as a business expense on the income statement, not as an asset on the balance sheet. Deferrals are adjusting entries that update a previous transaction.